International News

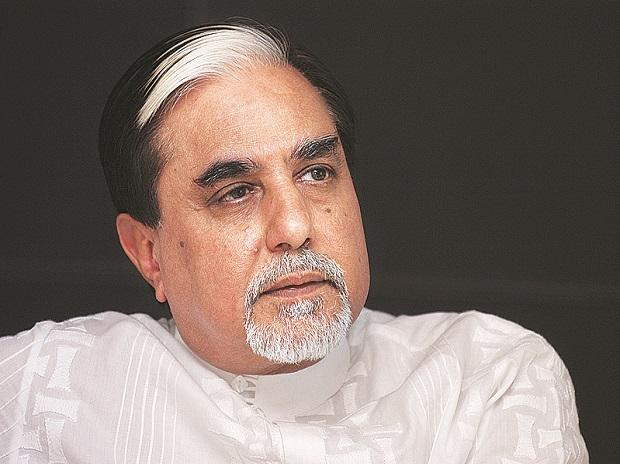

Indian media giant Essel Group, run by industry mogul Subhash Chandra, is seeking an extension to repay debt in order to avoid creditors liquidating its shares.The company faces a month-end debt repayment deadline. If that’s not met, creditors can sell shares in the group’s flagship Zee Entertainment Enterprises Ltd. kept as collateral against loans. The case highlights broader risks that borrowings backed by stock pose to the equity market. There’s a lot at stake with share-backed loans currently at about 1.9 trillion rupees ($26.5 billion).

Essel Group’s Chandra is seeking to sell assets ranging from a stake in the nation’s most valuable publicly traded TV network to roads. Shares of his Zee Entertainment Enterprises Ltd. have plummeted to the lowest level in five years.“We have certainly discussed the point pertaining to the extension as well, purely in the interest of deriving the right value for the precious assets,” said Punit Goenka, managing director and chief executive officer at Zee Enterprises in an emailed response, “The lenders have noted our view and have been extremely supportive.”

The media tycoon’s challenge is the first of what could be a string of tests this year for beleaguered business titans from Anil Ambani to the founders of the Emami Group. They have raised funds to expand their empires by pledging equity stakes in their firms and the clock is ticking as repayment dates loom.

Risks Mount

“Not everybody is going to come out of this alive,” said Jayanth R Varma, a professor at the Indian Institute of Management in Ahmedabad, referring to the founder’s funding predicament. “I can’t imagine that all the groups that are in trouble today will be able to sort out their mess.”...Read More

No comments:

Post a Comment