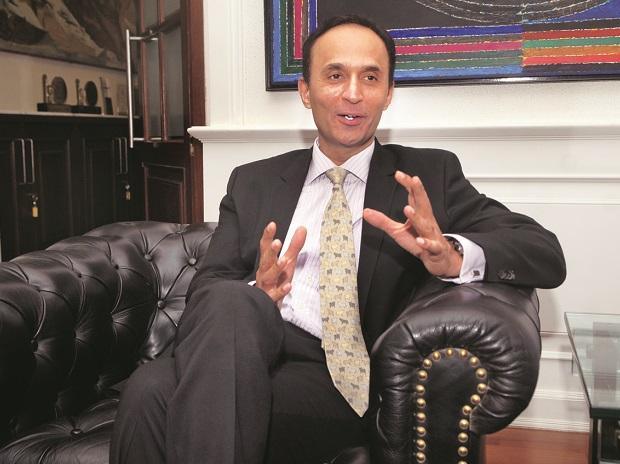

Breaking his silence over the Essel group’s dispute with Yes Bank, group patriarch Subhash Chandra said the bank should decide its role as shareholder of satellite TV broadcaster Dish TV India, or a lender, so that the group can accordingly take steps to settle the pending issues with the bank. In an interview, the founder of Zee group said the family's settlement offer is in Yes Bank’s court and the lender has not taken any steps yet to take the matter forward. “We are willing to give up control of Dish TV to Yes Bank, if the bank is interested in running the day to day operations of Dish TV as a shareholder. But if it’s a lender, then we are ready to negotiate to settle the account,” Chandra, 71, said.

After Yes Bank seized Chandra family's pledged shares following a default, the family’s stake fell to six per cent. The bank currently owns 25.63 per cent in Dish TV worth Rs 713 crore, as on Tuesday. The bank claims it has extended loans of Rs 5,270 crore to 10 different Essel Group entities between 2015 and 2018. According to Chandra, the promoter entities of Essel group owe Rs 4,200 crore but the bank has bunched several loans to other group companies, taking the total amount to Rs 5,270 crore. “We have already paid back 91 per cent of our lenders and we are ready to settle with Yes Bank by paying back more than what is the bank's stake in Dish TV,” Chandra said. “Our offer will be far better than other accounts where the bank has settled with a larger haircut.” A haircut is the amount the banks forego to settle a default account.