Company News

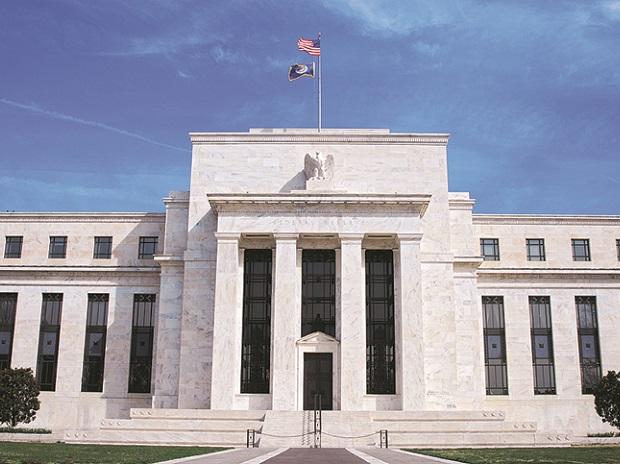

On May 1, the Federal Reserve viewed the American economy as having a solid footing and risks to the outlook were muted.That assessment has weakened demonstrably since, and Fed Chair Jerome Powell and many of his colleagues inside the US central bank on Wednesday signalled readiness to cut interest rates as required to shore up a US economic expansion that appears to be losing steam.

What exactly changed in seven weeks to alter the outlook so much?

Tump's trade disputes are weighing

America's trade relationship has grown more strained in recent weeks with China and Mexico, two of the United States' top trading partners. When the Fed held its April 30-May 1 meeting, Washington and Beijing appeared to be closing in on a trade deal that would avoid an escalation in the trade war between the two countries.

That changed on May 5, when President Donald Trump unleashed an angry barrage of tweets, complaining that China had reneged on promises it had made in the talks and threatening to ratchet up tariffs on Chinese goods.

The negotiations unravelled and Washington hit China with higher tariffs on some $200 billion worth of goods on May 10, prompting China to retaliate. Washington is also threatening tariffs on another roughly $300 billion in Chinese imports if the two sides don't reach a deal soon, with Trump and Chinese President Xi Jinping expected to meet at a Group of 20 summit in Japan next week.

Trump then turned his sights on Mexico, and on May 30 he threatened new tariffs on all Mexican imports if America's southern neighbour did not do more to stop the flow of migrants across the US border.

No comments:

Post a Comment