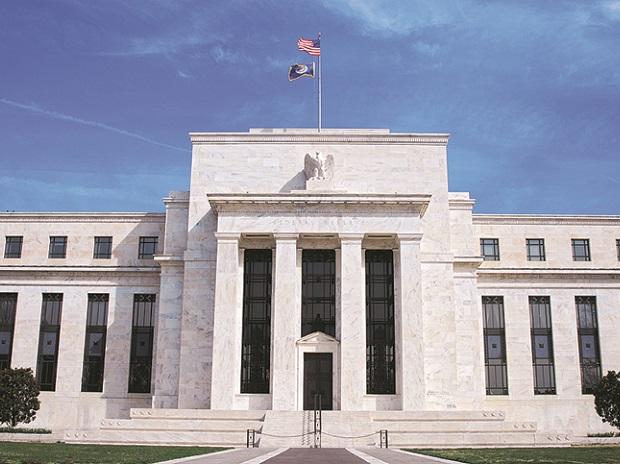

NEW YORK (Reuters) - The dollar held just under a 20-year high against a bushel of monetary forms on Monday before a normal Federal Reserve rate climb this week, with brokers zeroed in on the potential for the U.S. national bank to take on a much more hawkish tone than many anticipate.

The Fed has adopted an undeniably forceful strategy to financial arrangement as it handles expansion that is taking off at its quickest pace in 40 years. It is normal to climb rates by 50 premise focuses and declare plans to lessen its $9 trillion monetary record when it finishes up its two-day meeting on Wednesday.

However the odds are viewed as low, a few financial backers are looking for the chance of a 75 premise point climb, or a quicker speed of accounting report decrease than right now anticipated.

"A ton of dealers are guessing that the Fed won't withdraw from this hawkish position and you might in any case see a few hawkish amazements, and that is the reason the dollar is probably going to clutch its benefits heading into the gathering," said Edward Moya, a senior investigator with OANDA in New York.

Remarks by Fed Chairman Jerome Powell at the finish of the gathering will likewise be examined for any new signs on whether the Fed will keep on climbing rates to fight increasing cost pressures regardless of whether the economy debilitates...KNOW MORE