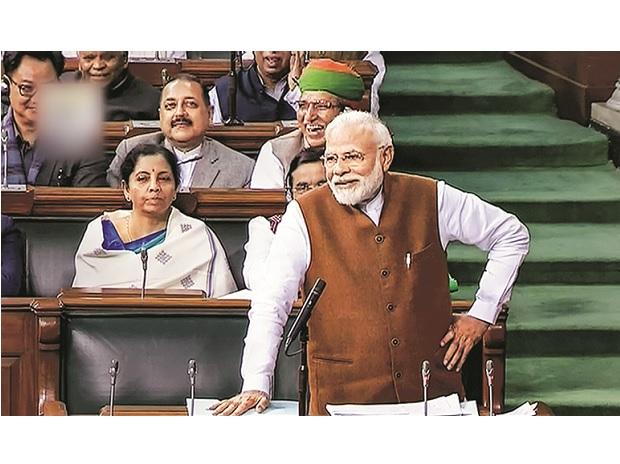

PM Narendra Modi on Thursday disclosed to Parliament that the present engineering of merchandise and ventures charge (GST), including more prominent weighting to assembling states, was his brainchild, which he had proposed as boss clergyman of Gujarat to then back pastor Pranab Mukherjee, however in the long run Arun Jaitley, the account serve during his administration's past term, included it into the law.

Answering to the conversation on the movement of gratitude to the President's location, the PM tried to safeguard the various revisions to GST, and said any change of such extent ought to have space for a remedial instrument. He said even the Constitution had been altered a few times.

On the National Population Register (NPR), the PM guarded the all-encompassing poll. In opposition to late explanations by different priests on the issue that the all-encompassing NPR survey was intentional, Modi said "little changes" were a piece of any ordinary managerial exercise of a legislature. The PM said information was required, remembering for the petulant inquiry on spot of birth of the dad of a respondent, to follow expanded relocation and decide the respondent's first language.

Congress pioneer Jairam Ramesh said the PM was "deceiving the House". Afterward, Ramesh said the "real truth was currently out in the open" with the PM himself demonstrating that none of the new NPR questions was "willful".

The PM underlined the requirement for cooperating to make India a $5 trillion economy. He said the administration had the option to keep up macroeconomic strength in the midst of intense worldwide condition. He likewise admonished all individuals to give recommendations on approaches to make the most of chances hurled by the current worldwide monetary circumstance...READ MORE